how to check unemployment tax refund on turbotax

The deadline to file your federal tax return was on May 17. Subtract line 5 from line 4.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

The IRS has just started to send out those extra refunds and will continue to send them during the next several months.

. Unemployment and Taxes Explained TurboTax Tax Tip Video. Instead the IRS will adjust the tax return youve already submitted. Add lines 1 2 and 3.

If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next several months. I filed my taxes with Turbotax and got them direct deposited back in March but with the CTC payments I am getting a check for some reason I was trying to figure out if my unemployment refund will be to the same bank as my tax refund or if im going to have to wait forrreevvveer for a. Enter the amount from Schedule 1 lines 1 through 6.

Free tax software users should be wary of paid upgrades. But since you still need to file a tax return you may be interested in some of the tax benefits available to you. The refunds are being sent out in batchesstarting with the simplest returns first.

Situations covered in TurboTax Free Edition includes. Prepare federal and state income taxes online. 100 Free Tax Filing.

This tax season there are key differences in. These free tax programs include reviews of your tax return and options to receive your tax refund by direct deposit or as a check in the mail. Tax credits tax deductions and itemized income tax returns are ways you may be able to reduce your taxable income or increase your income tax refund.

If you are filing Form 1040 or 1040-SR enter the amount from line 10c. Otherwise the IRS will mail a paper check to the address it has on hand. W-2 income limited interest and dividend income reported on a 1099-INT or 1099-DIV.

If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early. However TurboTax tops out at 389 for full-service tax prep while HR Blocks full-service options have open-ended pricing. The low end of TurboTaxs pricing to fill out your return for you is almost three times the cost of the low end of HR Blocks in-person service.

Get your tax refund up to 5 days early. However if you havent yet filed your tax return you should report this reduction in unemployment income on your Form 1040. If you are filing Form 1040-NR enter the amount from line 10d.

2021 tax preparation software. You should itemize deductions if they would exceed the standard deduction and result in a lower total taxable income than if you claim the standard deduction. If you are filing Form 1040 or 1040-SR enter the total of lines 1 through 7 of Form 1040 or 1040-SR.

I want to know my tax refund status When will I receive my tax refund. I want to know my status on refund TurboTax never filed my taxes I want a refund ASAP I want to know when i will be receiving my taxes. Learn more about unemployment and taxes like how to report unemployment compensation on your federal tax return and how to use IRS tax form 1099-G with this helpful tax tip video from TurboTax.

Efile your tax return directly to the IRS. The total number of returns the IRS received hit nearly 913 million through April 1 down 21 from a year ago. The refund will go out as a direct deposit if you provided bank account information on your 2020 tax return.

When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early. To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. TurboTax has a free basic tax filing version customers You can file with TurboTax Free Edition if you have a simple tax return A simple tax return is Form 1040 only OR Form 1040 Unemployment Income.

If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next several months. The status says it would be I want to know the status on my tax return I filed taxes on TurboTax into it and received an email and showing status that b. The IRS has not provided a way for you to track it.

Do not reduce this amount by the amount of unemployment compensation you may be able to exclude. You typically dont need to file an amended return in order to get this potential refund. You cannot check it.

TurboTax cannot track or predict. If you are filing Form 1040-NR enter the total of lines 1a 1b and lines 2 through 7. TurboTax cannot track or predict when it will be sent.

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Health Care And Taxes Are Coming Together Turbotax Can Help You Be Ready Save Money Turbotaxaca Sponsored Http Clvr Health Care Turbotax Tax Software

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The New Unemployment Benefits And Tax Relief Youtube

Irs Refund Tracker Why Is Your Tax Return Still Being Processed Marca

![]()

What You Need To Know About Unemployment Tax Refund Irs Payment Schedule And More

Tax Filing Season 2022 What To Do Before January 24 Marca

1040ez Google Search Financial Aid Tax Software Best Tax Software

Turbotax Launches The Turbotax Unemployment Center The Turbotax Blog

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

The Dollar S Decline In Global Reserves Fact Or Fiction In 2021 Filing Taxes Turbotax Hr Block

Where S My Tax Refund How To Check Your Refund Status Tax Refund Filing Taxes Tax

Ep294 Is A Heloc Still Tax Deductible Morris Invest Tax Deductions Heloc Investing

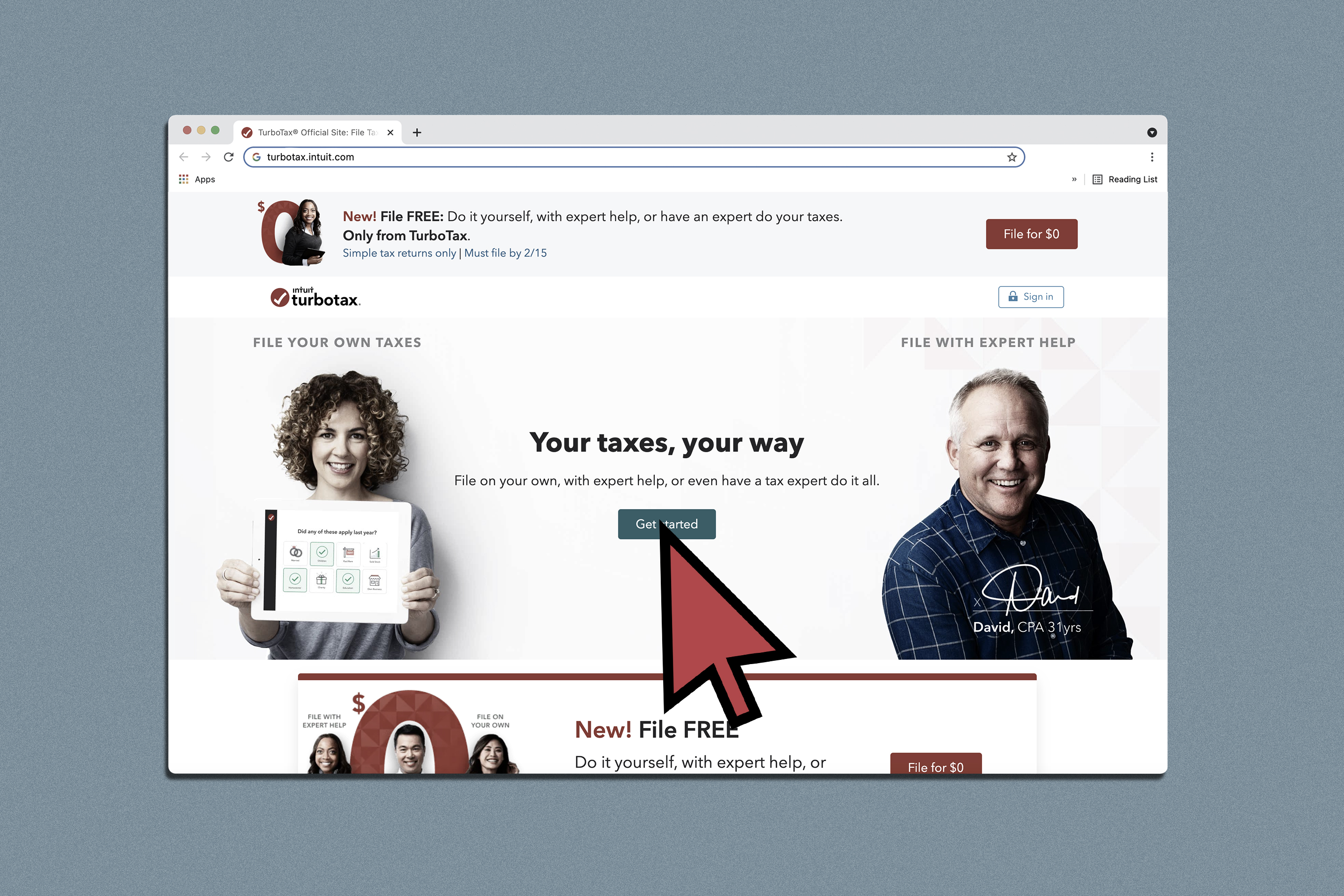

How To File Taxes For Free Turbotax 2022 Free File Change Money

Topic No 203 Refund Offsets For Unpaid Child Support Certain Federal And State Debts And Unemployment Compensatio Internal Revenue Service Tax Refund Topics

Deadline It S Over But Not The Complaining Tax Season Humor Accounting Humor Tax Deadline

Irs Announces E File Open Day Be The First In Line For Your Tax Refund The Turbotax Blog

How To Check Your Tax Refund Status Turbotax Tax Tips Videos

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor